Lithium and critical minerals have become the lifeblood of the global energy transition, powering everything from electric vehicles and grid-scale batteries to smartphones and advanced defense technologies.

As nations race to secure cleaner energy solutions, demand for these essential materials has surged to record highs—yet global supply chains remain fragile and constrained. Many of the world’s richest deposits are concentrated in geopolitically sensitive regions, making reliable production and new discoveries increasingly valuable.

The growing imbalance between soaring demand and limited supply is creating a once-in-a-generation opportunity, especially in companies positioned at the forefront of lithium and critical mineral development.

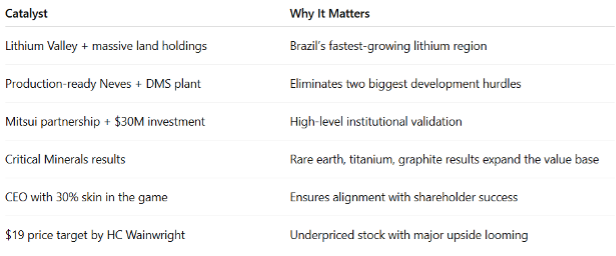

Atlas Lithium (NASDAQ: ATLX) doesn’t just own one of the fastest-advancing lithium projects in Brazil — it also holds a 28% ownership stake in Atlas Critical Minerals (OTCQB: JUPGF), its diversified critical minerals subsidiary.

Atlas Critical Minerals owns 218,000+ hectares of mineral rights for rare earths, titanium, graphite, uranium, copper, and nickel. Brazil, where the subsidiary operates, hosts significant rare earth deposits and holds the world’s second-largest graphite reserves.

This position gives ATLX direct exposure to a rapidly expanding portfolio of rare earth elements, titanium, graphite, nickel, copper, and uranium — all essential to the global electrification and defense supply chains.

Recent drilling at JUPGF returned remarkable results, including near-surface rare earth mineralization grading up to 28,870 ppm TREO, 23.2% titanium dioxide, and graphite concentrates at 96.6% purity — placing the project among Brazil’s most promising new critical mineral discoveries.

This 28% stake strategically extends ATLX’s reach beyond lithium, allowing it to capitalize on multiple megatrends — from EV batteries and wind turbines to advanced electronics and energy storage — while diversifying its risk and amplifying its growth potential.

Focused on moving from exploration to profitability; Atlas Lithium Corporation (NASDAQ: ATLX) is a U.S.-based mineral exploration company with the largest size and breadth of exploration projects for strategic minerals in Brazil, a premier mineral jurisdiction.

ATLX intends to be a leader in the provisioning of minerals essential to the transformation of the global economy from fossil fuels to electrification, a process which is expected to take decades.

Discover how ATLX is positioned to become the “Mineral Resources Company for the Green Energy Revolution!”

ATLX was featured in the "Top Picks" list from HC Wainwright with a target price of $19! See what the firm had to say below:

Atlas Lithium isn’t playing small ball! The company controls over 797 km² of lithium exploration areas – the largest lithium portfolio in Brazil.

But it’s Lithium Valley in Minas Gerais, Brazil, that could make ATLX a household name.

Over the last several years, Atlas Lithium has assembled Brazil's largest portfolio of lithium mineral rights among publicly listed companies.

ATLX holds three key projects that span the major lithium-mineralized zones in LV:

Atlas Lithium Corporation (NASDAQ: ATLX) just delivered a landmark milestone that investors cannot afford to overlook. The company announced that SGS Canada Inc. has completed a Definitive Feasibility Study (DFS) for its 100%-owned Neves Lithium Project in Brazil, revealing an eye-popping internal rate of return (IRR) of 145% and an ultra-fast payback period of just 11 months.

This low-cost, open-pit spodumene project, situated in Brazil’s lithium-rich Minas Gerais state, boasts an after-tax net present value (NPV) of $539 million and operational production costs estimated at only $489 per tonne of lithium concentrate—placing Atlas Lithium firmly among the world’s lowest-cost lithium producers.

Key takeaways investors must note:

CEO Marc Fogassa emphasized the significance: "The DFS indicates potentially outstanding returns for our initial vision of developing a focused, near-term, profitable lithium production asset with minimal capital requirements. The combination of low capital intensity and rapid payback is expected to create exceptional value for our shareholders."

For ATLX, the Neves Project isn’t just another lithium project—it’s a opportunity for what could become one of the most efficient and profitable hard-rock lithium operations in the world.

Within the global lithium industry, Brazil’s LV has emerged as a premier hard-rock lithium jurisdiction.

Brazil's advantages include year-round mining operations, lower labor costs, and a supportive government. The country’s lithium industry outperforms Australian producers on costs; Pilbara Mineral’s US$370M acquisition of a Brazilian lithium explorer in August 2024 highlights the region's importance.

"Investments in lithium production in Minas Gerais are projected to range from $3.9 billion to $5.8 billion by 2030," according to João Paulo Braga, CEO of the state investment promotion agency, Invest Minas.

Few countries besides Brazil have such an advantageous position to attract investment, as other Latin American nations face uncertainties and political risks.

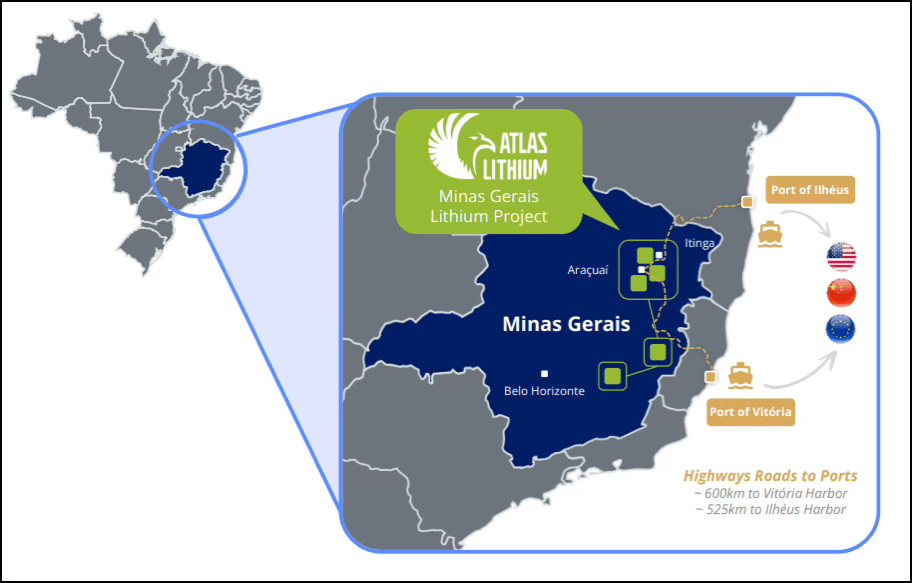

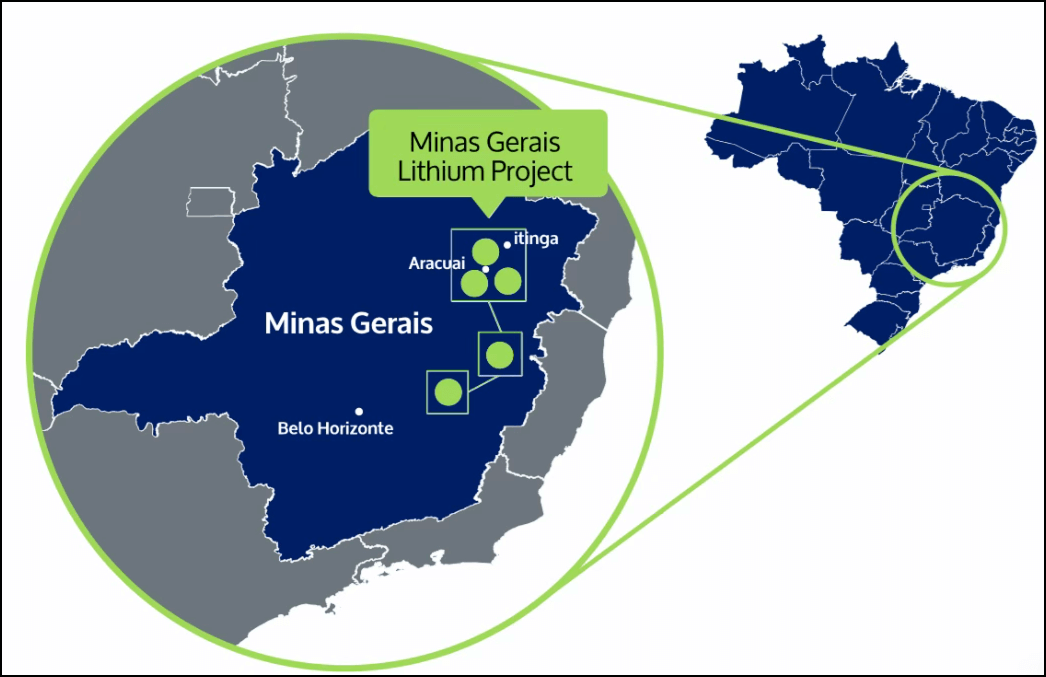

ATLX’s Minas Gerais Lithium Project is its largest endeavor and consists of 98 mineral rights totaling approximately 797 km2.

Several of the company’s mineral rights are located adjacent to or near mineral rights that belong to a large publicly traded competitor company which has demonstrated through extensive drilling the presence of lithium deposits totaling over 100 million tons, according to its publicly available filings!

This is a Highly Attractive Location:

◼ Resource Potential to Support Large Scale Operations

✓ The Brazilian Geological Service (CPRM) suggested that the region has at least 45 lithium deposits

✓ Adjacent to operational lithium mines in the region such as Sigma Lithium and CBL

◼ Licensing Fast Track to Speed up Project Execution – Atlas with Permits in Place

✓ Minas Gerais government created a fast-track process, under the InvestMinas Program, to facilitate project development and allow for licensing to be issued quickly

✓ Mining friendly jurisdiction: 300+ operating mines in the state of Minas Gerais

◼ Favorable Infrastructure

✓ Access to abundant renewable & clean energy sources and highway roads directly connected to intercontinental ports to supply main markets

Recent exploration activities at both the company’s Salinas and the Clear Projects have yielded significant progress, and such development bodes well for ATLX’s strategy of securing as many high-quality deposit areas within LV as feasible.

Atlas Lithium’s acreage borders Sigma Lithium (SGML), which had previously soared to multi-billion valuations. ATLX’s Clear Project is just 3.8 miles from Sigma’s Grota do Cirilo mine. And if you think that’s close—how about this: Atlas’s lithium processing manager played a key role at Sigma!

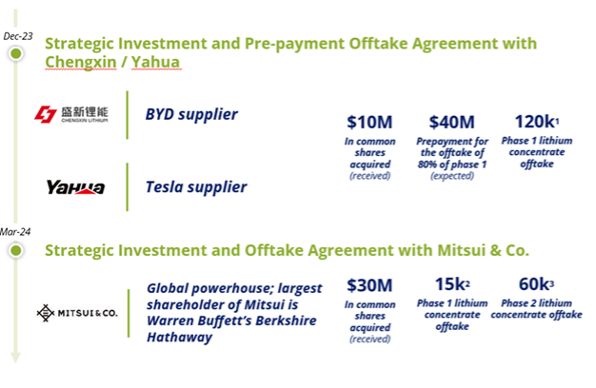

In 2024, Japanese mega-conglomerate Mitsui (yes, the one whose biggest shareholder is Warren Buffett’s Berkshire Hathaway) plowed $30M into Atlas Lithium at a 10% premium. The deal came with a massive lithium offtake agreement—highlighting that ATLX is not just a hopeful explorer. It’s on the fast track to revenue.

In a transformative development, Atlas Lithium secured a strategic partnership with Mitsui & Co., Ltd., one of Japan's largest global trading and investment companies with operations in over 60 countries. In March 2024, Mitsui demonstrated its confidence in Atlas Lithium's potential by making a substantial US$30 million strategic investment at a 10% premium to market price. The partnership includes a significant offtake agreement lithium concentrate from Atlas Lithium's Neves Project. Notably, Mitsui's largest shareholder is Warren Buffett's Berkshire Hathaway, adding another layer of institutional validation to Atlas Lithium's business model.

Atlas isn’t waiting around. Its state-of-the-art Dense Media Separation (DMS) lithium processing plant just landed in Brazil. Permitted and fully paid-for, this facility brings Atlas into elite company. It will be Brazil’s first modular DMS plant, and it’s engineered for eco-friendly, water-efficient lithium extraction.

Atlas Lithium’s processing plant pictured during preliminary trial assembly stage in South Africa.

Atlas Lithium’s processing plant pictured during preliminary trial assembly stage in South Africa.

CEO Marc Fogassa said it best: “We have overcome two of the most significant hurdles on our journey to production.”

Atlas’s CEO isn’t a suit. He’s a biotech MD and MIT-trained engineer turned investor—who just happens to own 26% of the company himself. That’s shareholder alignment you RARELY see in this sector.

Brazilian born CEO Marc Fogassa has a 25-year career in executive management, private equity/venture capital. He has extensive direct investing experience, including cross-border deal structuring, due diligence, management build-up, and Board of Directors oversight.

Fogassa double majored at the Massachusetts Institute of Technology (MIT), earning Bachelor of Science degrees in Electrical Engineering and Biology. He subsequently graduated from the Harvard Medical School with a Doctor of Medicine degree and later from the Harvard Business School with a master’s in business administration degree.

Marc Fogassa is the largest shareholder of Atlas Lithium himself, with ~26% of outstanding common shares. This is a vote of confidence from the man in charge and it showcases full CEO’s alignment with shareholder interests.

All three are in the heart of Lithium Valley, surrounded by proven multibillion-dollar resources. Recent exploration confirms spodumene at multiple locations.

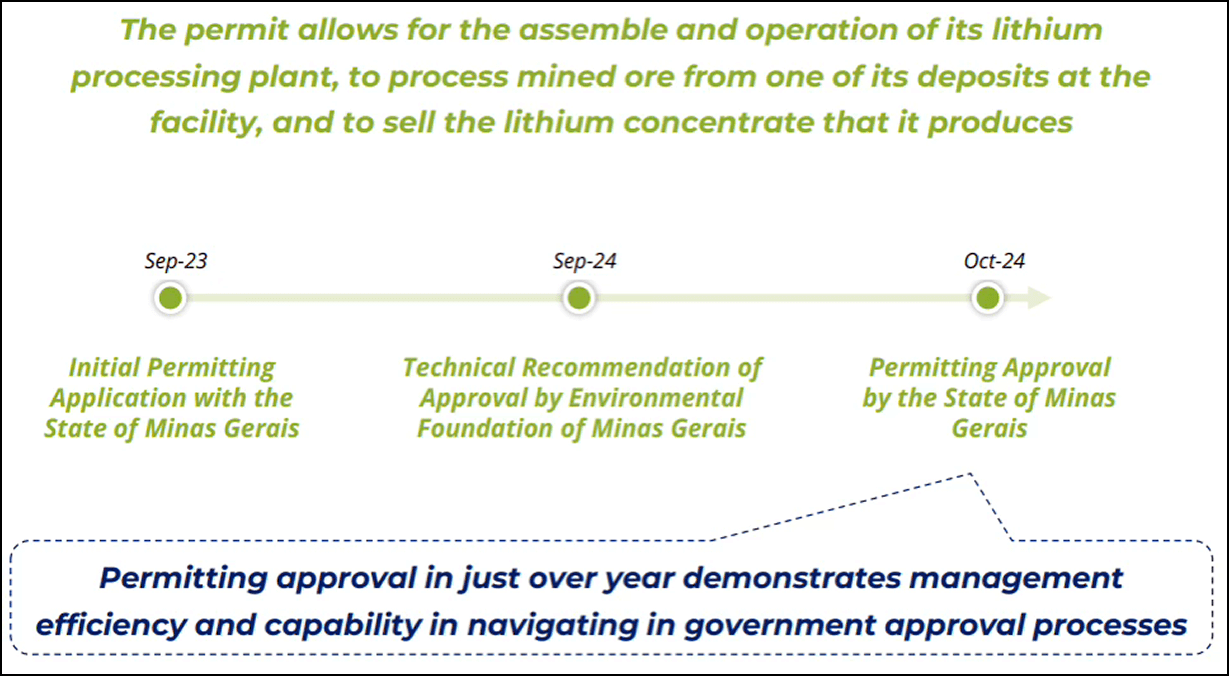

The Neves Project Has Already Received All Permits Needed to Assemble its Processing Plant and Operate!

Eduardo Queiroz joins Atlas Lithium as Project Management Officer (PMO) and Vice President of Engineering, bringing over 20 years of hands-on experience managing complex, large-scale mining projects, and making him the perfect addition to drive the Company's Neves Project to revenue generation. Mr. Queiroz has more than two decades of expertise in managing large-scale and complex mining projects, most recently as General Manager of Planning and Management at Bamin, a unit of Eurasian Resources Group, where he successfully led the strategic planning of several projects over US$3 billion, including an integrated iron ore mining project encompassing mining operations, processing plant, railway, and ocean port facilities. His comprehensive experience includes engineering oversight, environmental compliance, risk management, and the implementation of cost-efficient operational strategies. He holds an MBA in Project Management from Fundação Getúlio Vargas and a degree in Civil Engineering from the Universidade Federal de Ouro Preto.

"Eduardo's arrival could not come at a better time," said Marc Fogassa, CEO and Chairman of Atlas Lithium. "As we prepare to transition into production, his proven track record in the implementation of Brazilian mining projects will be instrumental in our success. We are honored and thrilled to have him on our team."

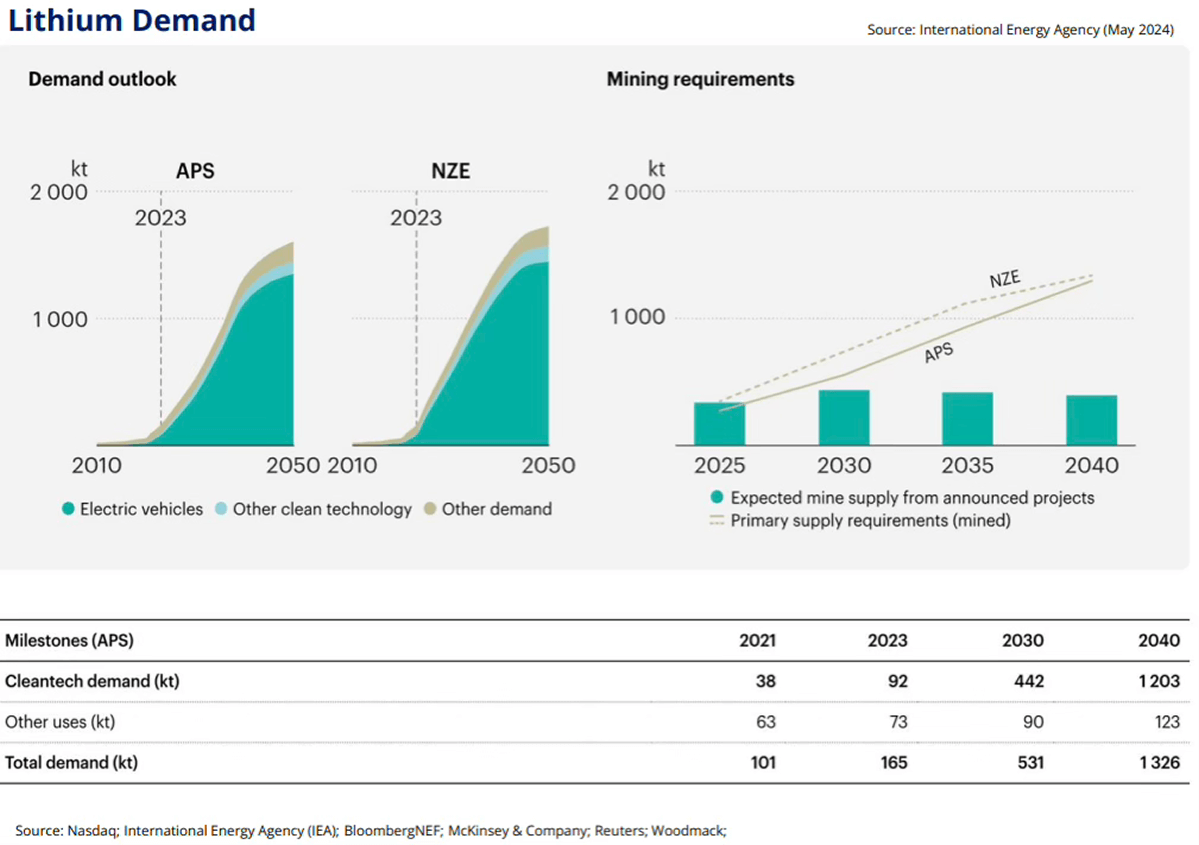

Lithium might just be the hottest commodity to watch as we get closer to 2030 and could yield long-term opportunities for ATLX!

Lithium is on the list of the 35 minerals considered critical to the economic and national security of the United States as first published by the U.S. Department of the Interior on May 18, 2018.

In June 2021, the U.S. Department of Energy published a report titled “National Blueprint for Lithium Batteries 2021-2030” (henceforth, the “NBLB Report”) which was developed by the Federal Consortium for Advanced Batteries (“FCAB”), a collaboration by the U.S. Departments of Energy, Defense, Commerce, and State. According to the Report, one of the main goals of this U.S. government effort is to “secure U.S. access to raw materials for lithium batteries.”

In the NBLB Report, Ms. Jennifer M. Granholm, the U.S. Secretary of Energy, states: “Lithium-based batteries power our daily lives from consumer electronics to national defense. They enable electrification of the transportation sector and provide stationary grid storage, critical to developing the clean-energy economy.”

The NBLB Report summarizes as follows the U.S. government’s views on the needs for lithium and the expected growth of the lithium battery market:

“A robust, secure, domestic industrial base for lithium-based batteries requires access to a reliable supply of raw, refined, and processed material inputs…”

“The worldwide lithium battery market is expected to grow by a factor of 5 to 10 in the next decade.”

An anticipated surge in demand, coupled with expanding supply capacities, indicates a potentially lucrative rebound for the lithium market which could present significant investment opportunities.

A lithium rebound could bode well for many lithium companies including Atlas Lithium Corporation (NASDAQ: ATLX).

The rebound in lithium stocks got underway in 2024 when the world's largest miner of the metal, Albemarle revealed plans to cut production and spending. Smaller peer Arcadium Lithium quickly followed. The moves stirred hopes that lithium supplies would soon revert closer to current demand.

Investor enthusiasm continued in October of 2024 when the mining world's second-largest enterprise, Rio Tinto, sealed a $6.7 billion deal to take over Arcadium. The acquisition will make Rio a top lithium supplier. Why did Rio Tinto make such a big move? The mining giant is moving to solidify its position when lithium prices are near cyclical lows.

The Battery Metals Market has seen substantial growth, driven primarily by the increasing demand for electric vehicles (EVs) and renewable energy storage solutions.

These battery metals are being utilized more frequently in batteries for consumer electronics, electric vehicles, and other uses. Brine and hard rock deposits found in countries with economies like China, the Americas, Australia, Canada, Brazil, and Portugal are sources of lithium metal. In lithium-ion batteries, cobalt is most frequently utilized as the cathode material. Nickel has a high energy density and storage capacity, making it a good choice for battery applications. Increased use of smartphones, tablets, and other electronic gadgets has positively impacted the global battery metal market.

According to recent market reports, the global battery metals market is currently valued at around $11.35 billion and is projected to reach $22.87 billion by 2033, growing at a CAGR of 8.1% due to increasing demand for electric vehicles and consumer electronics, with key battery metals including lithium, nickel, cobalt, manganese, and graphite; the Asia-Pacific region is the largest contributor to the market by revenue.

Large global partners validate Atlas Lithium’s business model, assets, and team.

On January 28, 2025, H.C. Wainwright & Co., a respected U.S. investment bank, has designated Atlas Lithium (NASDAQ: ATLX) as one of its top picks for 2025, highlighting the company's strategic positioning and growth potential. The investment bank's analysis points to Atlas Lithium's progression toward production, emphasizing the significance of its fully-paid DMS plant and the company's strong partnerships with major lithium companies in Asia. With a “BUY” recommendation, H.C. Wainwright's research underscores Atlas Lithium's potential to become a key player in the global lithium supply chain, particularly noting its advantageous position in Brazil's Lithium Valley and the company's efficient operational model.

Lithium powerhouse Atlas Lithium (NASDAQ: ATLX) is uniquely positioned at the crossroads of two of the world’s most powerful resource trends — lithium and critical minerals.

As the largest holder of lithium exploration acreage in Brazil, ATLX sits at the heart of the next global lithium boom.

But what also sets it apart is its ~28% equity stake in Atlas Critical Minerals (OTCQB: JUPGF) — giving investors direct exposure to a vast portfolio of rare earths, titanium, graphite, uranium, copper, and nickel at a time when these materials have become the backbone of the global energy transition.

With global demand for battery metals and critical resources surging — and supply chains under pressure — companies capable of producing these materials securely and efficiently stand to benefit the most. Atlas Lithium is one of the few small-cap names that offer dual exposure to both markets, backed by Wall Street coverage, institutional investment from Mitsui, and industry-leading project economics featuring a 145% IRR and rapid 11-month payback.

As the world races toward electrification, Atlas Lithium represents a diversified gateway into the metals that power the modern economy. Its combination of lithium dominance, critical mineral leverage, and strategic partnerships positions ATLX as a company to watch — and potentially one of the most compelling growth opportunities in the global clean energy supply chain.

With world-class project economics, ultra-low costs, a rapid path to production, and strategic funding already in place, ATLX is emerging as a standout contender in the race to supply the next wave of global electrification!

ATLX is ticking every box:

And it’s doing all of this with a sub-$140M market cap—a rounding error for majors circling the space.

Backed by experienced leadership, regulatory clarity, and a pipeline of high-potential assets, the company is executing on a clear and compelling roadmap toward scalable, high-margin lithium production.

As the company continues to execute on its expansion plans across its promising Brazilian lithium assets, ATLX intends to capitalize on the surging global demand for critical battery materials and delivering substantial value in the rapidly evolving clean energy landscape.

We are engaged in the business of advertising and promoting companies. All content on our website is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Huge Alerts nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Huge Alerts. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Huge Alerts makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website.

Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results.

Generally, the information regarding a company profiled or discussed on this website is provided from public sources hugealerts.com makes no representations, warranties or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Huge Alerts has no obligation to update any of the information provided. Huge Alerts, its owners, officers, directors, contractors and employees are not responsible for errors and omissions.

From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Huge Alerts encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content.Huge Alerts, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Huge Alerts control, endorse, or guarantee any content found in such sites. Huge Alerts does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Huge Alerts, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Huge Alerts, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Huge Alerts uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm.

Income Disclaimer

Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success, and are not responsible for your actions.

Huge Alerts has been retained by Atlas Lithium Corp (NASDAQ:ATLX) to perform promotional and advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from Atlas Lithium Corp (NASDAQ:ATLX) . Questions regarding this website may be sent to editor@hugealerts.com

Huge Alerts has been compensated by Atlas Lithium Corp (NASDAQ:ATLX) for the total sum of $2,593,000.00 This agreement has been on going since Febuary of 2024 and is for the marketing of Atlas Lithium Corp (NASDAQ:ATLX) which services include the issuance of this release and other opinions that we release concerning of Atlas Lithium Corp (NASDAQ:ATLX) . Huge Alerts has not investigated the background of Atlas Lithium Corp (NASDAQ:ATLX) the hiring party, or Atlas Lithium Corp (NASDAQ:ATLX) Anyone viewing this newsletter should assume Atlas Lithium Corp (NASDAQ:ATLX) or affiliates of Atlas Lithium Corp (NASDAQ:ATLX) own shares of Atlas Lithium Corp (NASDAQ:ATLX) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Huge Alerts has received this amount as a production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements regarding Atlas Lithium Corp (NASDAQ:ATLX)